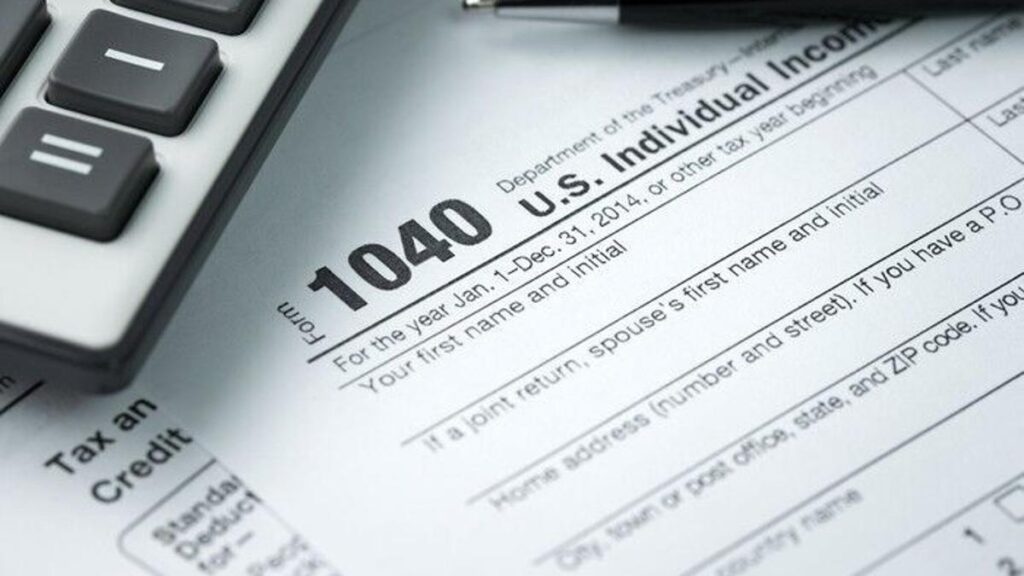

It’s no secret that a lot of people hate being subject to taxes. Naturally, we’re not talking about business owners or corporations that don’t even try to avoid paying them – as they are usually exempt anyway.

We are talking about everyday people that just want to pay less at the end of each month. Attempting to do this is not illegal – however, it may be extremely difficult and, quite contradictorily, rather costly.

In fact, according to law firms such as Kaczmarek & Jojola PLLC, many of the strategies that people use to avoid paying taxes are more than just costly, especially in the long term. Let’s take a look at how a strategy that you may currently be using can become really expensive really quick!

Strategy 1: Traditional IRA

Firstly, we’re going to see how opening an IRA (a traditional one, that is) sounds good at first but will cost you in the future. Not only that, it will be costly in moments when you might actually need a large amount of funding in your account.

This particular strategy is based on the fact that any funds that one sends to their IRA are not subject to any tax – at the moment. Instead, you pay tax when you withdraw said money from your traditional IRA.

What’s the main disadvantage of this strategy?

- Placing money into an IRA allows you to save little by little in taxes. Naturally, once you have a decent amount and decide to start withdrawing, you’ll be met with increased taxes, according to the amount placed in the IRA, as well as the amount you withdraw.

A better option would be a 401(k) initiative. Any amount put into such a plan will accumulate in a tax-free environment. In other words, you can get free money with this particular option.

Strategy 2: Annuity Buying

As some of you might know, an annuity is basically a savings account, the only difference being that it’s opened with an insurance company. Naturally, the latter characteristic implies that the account can be exempt from tax. That being said, there is a downside.

Namely, having your funds sheltered from tax means that you pay extra for the privilege that this service gives you, so to say. You save by not paying any taxes, but this service costs you – quite a lot, in some cases.

One could possibly opt to rely on an annuity when they have everything settled in their lives and simply don’t want to pay any taxes on their savings – but can also afford to pay for that particular privilege.

If your goal is to avoid additional expenses at this very moment, an annuity is not recommended for you.

Strategy 3: Whole Life Insurance Policy

This type of policy is often advertised as having interest that is completely void of taxes. In short, people often think that when you put your money into such a policy, it accumulates interest and, when you want to withdraw something, you are not subject to any fees or taxes.

Unfortunately, that’s not the case. Why? Because in terms of investments, they are actually considered high risk due to:

- Being known for their low rates of return. Some of the options with the lowest returns are said to be more effective than whole life insurance policies.

- The fact that in the unfortunate case of your death, everything saved in your whole life insurance plan vanishes. Your family will get only the value of the policy and nothing more.

Naturally, depending on how it is advertised, such a policy might sound too good to be true – that’s because it is. Salespeople manage to lure people in with one beautiful promise – that they can avoid paying taxes and save money at the same time, but there is always a downside.

Strategy 4: Dragging on the Mortgage

Speaking of losses in the long-term, dragging on a mortgage for too long can be something you might regret later. First of all, it’s worth mentioning that due to the interest of your mortgage, you save money in taxes throughout the period that you are paying it off.

However, the important fact here is that the deduction in taxes is not comparable with the interest rate you are getting. Basically, you may smile at a lower amount paid on monthly or yearly taxes, but ultimately the interest rate will be set to your disadvantage.

What can happen in the long term?

- Well, you can drag the mortgage on and on and, eventually, save around $2500. However, to save $2500, you have to pay $10k a year on the mortgage.

- If you don’t care too much about the mortgage, it can be paid off immediately. By doing this, you say goodbye to the $2500 that you could save in taxes, but enjoy the $10k that you won’t have to pay the following year.

It’s very obvious why you should never drag on your mortgage – no matter how good it may look on your tax returns.

How to Save Money/Avoid Taxes?

The best way to get an idea of how to save funds on tax payments is to consult with a tax professional. They can tell you of all the legal ways through which both you and your small/local business can pay less taxes and enjoy more savings.

Naturally, it goes without saying that you should avoid anything that looks either too good to be true or illegal!

The Bottom Line

In the end, you should not consider any of the four strategies mentioned above as a good way to avoid paying (more) taxes. They simply do not work – they might look advantageous at the moment, but they’ll come with higher costs in the long run.

On top of that, if you know how to manage your expenses, funds, and savings, you won’t need any fancy ways of avoiding paying your taxes. You can still pay your taxes accordingly while affording any luxury you want and saving money in something like a retirement fund as well!