Ensuring accurate and timely employee payments is crucial for running any business effectively. However, traditional payroll processing methods are often time-consuming, prone to errors, and require significant resources.

To tackle these challenges and optimize payroll operations, more and more businesses are adopting modern solutions, such as paystubs.net, which offer efficient pay stub generation.

By automating the check stub generation process, these innovative tools streamline payroll management, enhancing overall efficiency.

The Role of Paycheck Stub Generators in Payroll Management

What is a Paycheck Generator?

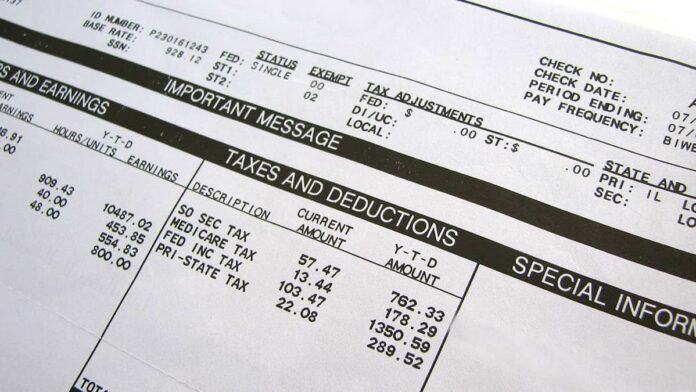

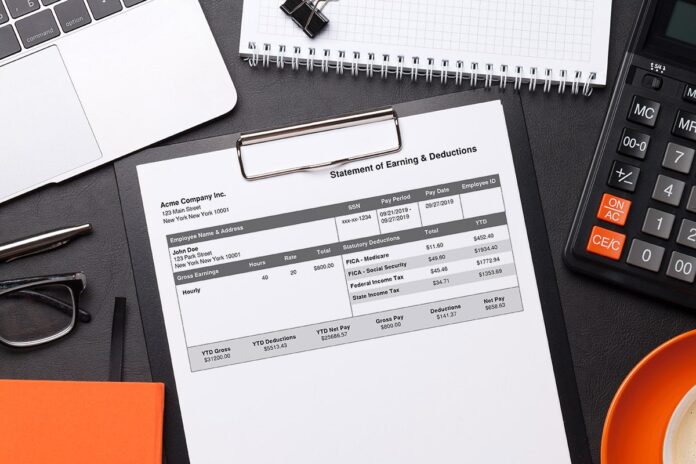

A paycheck generator is a software tool designed to create pay stubs, also known as check stubs, for employees. A payroll stub is a crucial document accompanying an employee’s paycheck and providing a breakdown of their earnings and deductions.

Traditionally, payroll administrators created payslips manually, consuming significant time and effort. Payslip generators automate this process, enabling businesses to produce accurate and professional pay stubs effortlessly.

Features and Functionality

Paycheck stub makers come equipped with various features that facilitate seamless payroll management.

Automated Calculation of Wages

One of the key benefits of using these tools is their ability to automatically calculate wages based on the hours worked and the employee’s pay rate. This feature eliminates the risk of human errors in payroll calculations, ensuring employees receive the correct compensation.

Inclusion of Essential Information

Salary stubs typically contain essential information such as gross earnings, taxes withheld, deductions, and net pay. Check stub generators efficiently incorporate all this information, presenting it clearly and organized.

Customization Options

Businesses often have unique payroll requirements. Payslip generators offer customization options, allowing companies to add their logos, personalize the layout, and include any additional information specific to their needs.

3 Advantages of Using Pay Stub Generators

1. Time and Cost Savings

Implementing payroll stub generators leads to significant time and cost savings. The automated process reduces the workload of payroll administrators, freeing them to focus on other crucial tasks. Moreover, the elimination of paper-based systems saves on printing and stationery costs.

2. Accuracy and Compliance

Payroll errors can lead to disgruntled employees and compliance issues. Paycheck stub generators ensure precise calculations and adherence to tax regulations and labor laws, minimizing the risk of non-compliance.

3. Employee Empowerment

Check stubs generated by payslip generators provide employees with transparent information about their earnings and deductions. This level of transparency fosters trust and empowers employees to keep track of their finances effectively.

Choosing the Right Payslip Generator

Evaluating Business Needs and Requirements

Before selecting a salary stub builder, businesses must assess their specific payroll requirements and the scale of their operations. Understanding these needs will help in choosing the most suitable tool.

Key Factors to Consider

Security and Data Privacy

Payroll data is sensitive information, and it is crucial to ensure that the salary stub generator complies with industry standards for data security and privacy.

Integration with Existing Payroll Systems

Businesses should consider whether the pay stub generator can integrate seamlessly with their existing payroll software or accounting systems to avoid data duplication and streamline the overall process.

User-Friendly Interface

A user-friendly interface is essential for smoothly adopting the payslip creator across the organization. It should be easy for payroll administrators and employees to use.

Template Options and Flexibility

Having a variety of paycheck stub templates to choose from and the ability to customize them is advantageous, as it allows businesses to create professional-looking check stubs tailored to their brand.

Implementing Payroll Stub Generators in Payroll Processes

Step-by-Step Integration Guide

Data Import and Employee Information

Businesses must import employee information into the system to use a paycheck stub generator. This includes employee names, pay rates, tax information, and deductions.

Setting Up Payroll Parameters

Configure it with the necessary payroll parameters, such as pay periods, overtime rules, and tax rates.

Generating Salary Stubs and Reviewing for Accuracy

Once the system is set up, payroll administrators can begin generating paycheck stubs for each employee. Before finalizing, it is essential to review the payslips for accuracy.

Distributing Payslips to Employees

Salary slips can be distributed electronically or in print, depending on the company’s preferences. Many pay stub generators offer online portals where employees can access their pay stubs securely.

Overcoming Challenges in Implementation

Addressing Data Compatibility Issues

During implementation, businesses may encounter data compatibility issues when integrating the payroll stub creator with their existing systems. This challenge can be mitigated through proper testing and support from the vendor.

Training and Familiarizing Payroll Staff

To ensure a smooth transition, providing adequate training to payroll staff on using this tool effectively is crucial.

Ensuring Data Security During Transition

Data security should be a top priority when migrating payroll data to a new system. Businesses must take measures to protect sensitive employee information during the transition.

Ensuring Compliance and Legal Requirements

Understanding Compensation Stub Regulations

Wage stubs must comply with federal and state regulations, which may vary depending on the location of the business. Employers must be aware of the mandatory information that needs to be included in them.

How Pay Stub Builders Assist in Compliance

Pay stub generators can significantly aid in compliance by automatically generating pay salary stubs that include all required information accurately.

Conducting Regular Audits for Accuracy and Compliance

Regular audits of payroll records and compensation slips are essential to maintain compliance and accuracy. Wage slip creators simplify this process by providing organized and accessible data.

Payroll Stub Creators and Employee Experience

Empowering Employees with Transparent Information

Accessible check stubs empower employees to better understand their earnings, deductions, and taxes. This transparency fosters trust and ensures a positive employee experience.

Accessing Pay Stubs Online

Paycheck stub makers often provide online portals where employees can access their check stubs conveniently, saving time and reducing paper waste.

Resolving Payroll Inquiries and Discrepancies

The clarity provided by payroll stubs generated by check stub generators enables employees to identify and resolve any discrepancies in their pay, leading to increased satisfaction and reduced administrative burden.

Conclusion

Pay stub generators play a vital role in streamlining payroll management for businesses of all sizes. By automating the process of generating check stubs, these tools save time, reduce errors, and enhance employee experience.

As businesses seek efficient and compliant payroll solutions, check stub generators will remain crucial in achieving streamlined payroll operations. Embracing this technology empowers companies to focus on their core operations while ensuring a seamless payroll experience for their employees.