The vast majority of students looking to attend college will need to take out some type of loan. This financial aid helps them to compensate for tuition fees, housing, and textbooks associated with getting a higher education. One of the main reasons so many students willingly sign up for this option is because the majority of lenders won’t require that you reimburse anything until you graduate. While this can be an incredibly tempting offer and one that draws many young people in, it can also be downright difficult to afford the immense fees and interest rates once you finally receive your degree.

Depending on the type of school you went to a couple with how long you attended, you could be looking at a loan that has tens of thousands of dollars that need to be paid in full before the account is considered to be satisfactorily met. Some loans even cost students a few hundred thousand dollars, all with the promise that they can have the balance paid off quickly once they graduate and secure a solid job within their career field. Unfortunately, many young professionals obtain degrees that aren’t necessarily in high demand or they simply have a hard time finding a reliable job because of the competition within the area they’re living. Paying off those old debts can help to give you an edge in life so that you can go on to buy a home, vehicle and start a family.

Consolidate Your Debts

Consolidation simply means taking all of your debts and lumping them into one account. This option is ideal for individuals who might have old student loans as well as credit card balances and other debts. Rather than have multiple bills, you’re able to make one payment a month and not have to worry about your bills getting confusing. Another key benefit of consolidating onto one account is that you will ultimately save money.

Rather than be putting your hard-earned money towards multiple interest rates, you’re paying just one when you go to fulfill your bill each month. You may even be able to get locked into a rate that is lower altogether, helping to save you plenty over time that you otherwise would have paid in interest.

Consider Refinancing

The majority of accounts given to students when attending college come with high-interest rates and ridiculous fees. Refinancing allows you to extend the time it’ll take you to pay off your debts while eliminating high, burdensome interest fees. This ultimately lowers your premium each and every month, making the bills more affordable. This is a great choice for individuals who are unable to find work after graduating or who have been subject to compensating the loan for quite some time and are ready to lower these expensive, difficult dues.

Whenever you look into refinancing, it is crucial that your goal is to lower interest rates and extend the term length. If you’re refinancing with a lender who is offering a higher interest rate than you already have, you’re not going to be saving the amount of money that you both want and need.

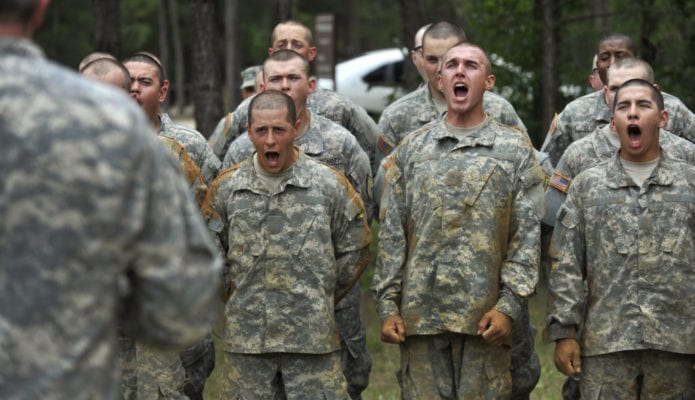

Join the Military

While it may not be your first choice, joining the military can help to get those old student loans paid off quickly and easily. Most branches offer some type of military loan forgiveness for personnel. Oftentimes, this is capped at about $20,000, though you’ll want to talk with your recruiter to find out more about what to expect when signing up for military duty. There are many different perks that come with joining the military.

Not only can you benefit from their student loan forgiveness programs, but you will lock in free healthcare for life, a pension and the ability to learn many useful skills that can help to improve your career. Most branches require that applicants complete boot camp before beginning to earn these benefits, so it’s important to prepare yourself for this process. Additional information on military loan forgiveness can be found at Earnest.com.

Work with Your Creditors

Most crediting agencies aren’t run by horrible, money-hungry people. They are ordinary people just like you who are simply doing their job to collect on past dues and debts. Because of this, you may be able to work with them to lower costs associated with old balances or come to an agreement on different terms. For example, you might want to consider utilizing an income-based repayment plan, which basically means that a small portion of your income will go towards compensating the lender. Likewise, the creditor may be able to work with you on lowering interest or reducing the amount that you owe altogether. If need be, get a financial or debt lawyer involved when working with these agencies.

Make Extra Payments

One of the worst things you can do when you have a debt of any kind is to only meet the minimum payment due. Most of the amount you’re putting towards the bill each month is going towards interest rather than its principal. Because of this, it’s a smart idea to put more towards your loan each month and to make extra payments whenever you possibly can. If you need to earn some extra cash to accomplish this, you’ll want to think about taking some overtime at work, asking for help from family members or doing some side or freelance work.

The more money you earn, the more you’re able to put towards these dues and the sooner you’ll pay off the balance in full. Use a financial calculator to find out how much you’d have to put towards the balance each year in order to get it paid off quicker, and try to meet this by increasing your income and saving up more money. Keep in mind that some lenders have a pre-payment penalty in place, which actually penalizes customers who try to put more towards their balances each month. If your lender does not have this type of penalty against customers, it’s a good idea to try to put more towards the balance as often as you possibly can.