When we go to deposit our money in the bank, we never think that anything will go wrong. The thought of a bank collapse is always in the realm of the impossible for the average customer. However, history has shown that this can happen and has happened repeatedly.

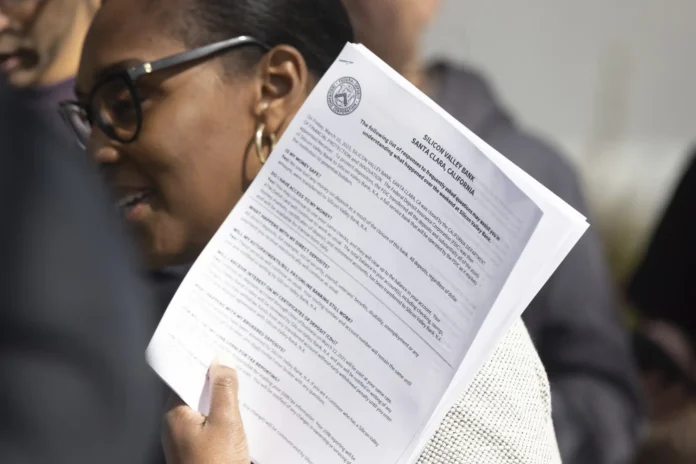

Just recently, two banks collapsed in the United States – Silicon Valley Bank, with $210 billion in assets and about $198 billion in customer deposits, and New York’s Signature with an asset value of about $110 billion and customer deposits of almost $89 billion.

In fact, Silicon Valley Bank (SVB) was regarded as among the top twenty banks in the United States. Despite this, these banks collapsed. You can read more about this news here: https://www.cbsnews.com/.

This article will be focused on discussing how you as an individual can secure your finances against such collapses. We will not be delving into why the banks collapsed as that will be beyond the scope of this article.

We will provide you with simple tips that can help you better manage your finances and investments so that your financial present and future are secured even with a bank collapse.

Preparing against a Bank Collapse

There are several steps you can incorporate into your regular financial processes to keep you in a state of perpetual preparedness against a bank collapse. Let us quickly look at a few of these:

1. Emergency Funds

Having an emergency fund is important for more than just preparing against a bank collapse. It can come in handy for all kinds of financial emergencies. These include a drop in income, loss of employment, sickness, and more.

Always ensure that you have an emergency fund that can take care of your basic bills for up to 6 months. This is something you should begin to build by setting aside an amount of money from your income.

Funds like these are usually kept in regular savings accounts, high-yield savings accounts, or other investment instruments. Since we are particularly guarding against bank failure, you may want to consider keeping these emergency funds in a money market account or certificates of deposit. The important thing is to ensure that the funds are easily accessible. You can learn more about how to set up an emergency fund here.

2. Spread Out Your Savings

Above, we mentioned the importance of building an emergency fund. The truth is that you may not be able to completely keep your funds away from the bank. Your next best option will therefore be to spread these funds across different banks. Unless the world is practically ending, it is not likely that all banks can collapse at the same time.

This is the same strategy that investors use when they “hedge” their investments. They simply spread their capital across different investment vehicles so that there can be a kind of balance. If one investment is doing very well, it can make up for the loss in another. This is a strategy that you have to understand.

3. Keep Some Cash in Hand

This is not something that governments encourage which is why there will always be a cap to how much you can withdraw from your ATM, how much you can travel with etc. Keeping some money in cash is a different kind of emergency fund. For this, you do not need as many funds. You just need something little that you can use briefly if there is an emergency that makes it impossible for you to get cash from the bank.

You can keep this cash in a safe deposit box, a home safe, or any other place that is secure but also within easy reach. Remember that this should not be very substantial cash, just something to tide you over for a noticeably brief time.

4. Pay Close Attention to Your Bank

Do not just deposit your funds in a bank and then go your merry way. You should always pay close attention to the financials of the bank. Read its financial statements and reports. Listen to experts and always be on the lookout for any indication that there is a problem.

Banks do not just collapse. There are always signs that the board will try hard to cover and find a fix for it before it escalates. The biggest issue that leads to a bank collapse is usually solvency – that is when they do not have enough cash to meet the withdrawal needs of their depositors. Once you notice signs, it is better to pull your funds and then find out that you were wrong than to leave your funds and then find out you were right.

5. Understand what FDIC Insurance Entails

FDIC Insurance is an attempt by the government to give depositors confidence to keep their funds in the banks. This insurance cover guarantees your deposit up to a certain amount. It is therefore important that you understand the details of this insurance so you know what you can claim in the event that your bank collapses.

Investment as a Tool for Protecting against Bank Collapse

While your primary reason for investment is to secure your financial future, when done well, it can also protect you from the effects of bank failure. Below are some things you can do:

Portfolio Diversification

This is actually a standard investment practice that can help you with more than just securing against bank failure. This spreads out your investments so that a fall in one area will not decimate your investment.

While you naturally expect all your investments to do well, this may not always be the case. You may find that some are not doing as well as others. Thanks to well-planned diversification, you can still enjoy overall growth when your investments that are doing well can assimilate the losses from those not doing so well and still show a profit.

Investing in Precious Metals

This is one investment that has seen an upsurge in recent years. As many countries face economic downturns, many investors are now turning to precious metals like gold, silver, etc. These commodities are great investment options because they are not affected by the stock market or bank failures.

You can invest in buying bullion and you can set up a precious metals IRA account with a reputable company. If you need help choosing a company to invest with, you can check out Goldco for guidance. By investing in gold, silver, and other precious metals, you put your investment out of the reach of the fluctuating financial market.

Work with a Financial Advisor

Working with a financial advisor can help you navigate this financial journey a lot better. Because they have a better understanding of the entire labyrinth of financial strategies, instruments, languages, and tools, they are in a better position to help you manage your funds, plan your investments, and come up with a strategy that will help you achieve your financial goals.

It is, however, important that you make the right choice when choosing a financial advisor. After all, financial experts have been known to lose their investments and go bankrupt. To this end, you must ensure that you choose an advisor that fits your lifestyle and will not be eager to take unnecessary risks with your finances.

You can learn how to choose a financial advisor that will be right for you here: https://money.com/.

With all that said, you should get as informed as possible on financial matters so that you will not be completely at the mercy of any financial advisor you choose to work with. If you have a basic knowledge of financial matters, you will be able to understand the options laid out to choose and choose the one that you know will best fit your financial goals.

Conclusion

No one wants to work for years only to lose all they have worked on because a bank collapsed. We have taken some time to outline simple steps you can take both to mitigate the effects of such an occurrence and also to reduce the likelihood of you having such an experience.

By carefully going through and understanding all that has been shared in this article, you will have set yourself on the right course to securing your financial future regardless of what happens with the banks around you.