Fintech apps have become very popular in recent years. They allow you to manage your finances, invest money, get loans, and perform many other operations. There are a huge number of products on the market today. Their popularity continues to grow as they offer convenient, fast, and innovative solutions. That’s why many people are thinking about fintech app development.

If you are looking for a company to help you develop a fintech app, Purrweb is a software development agency that specializes in creating custom software solutions, including fintech apps. They have experience working with startups and established businesses and can provide you with a team of skilled developers to bring your idea to life.

What is the Demand for Such Projects in 2024?

According to experts, demand will continue to grow in 2024. There are a lot of factors that make this a profitable market for developers. More and more people are starting to use smartphones and mobile apps to manage their finances.

With advances in technology and artificial intelligence, new products are becoming more innovative and offer new ways to manage finances. Investors continue to show interest in such startups, which creates opportunities to obtain investment and funding for new app development.

It can be said that creating a new project in 2024 remains a relevant and profitable area for investment and development. However, as in any other field, success depends on the quality and innovativeness of the product, as well as the effectiveness of marketing and strategic decisions.

How Fintech Apps Work

They allow you to manage your finances, access banking services, invest money, pay for goods and services, and much more.

One of the main benefits is convenience. You can perform most transactions using your cell phone anytime, anywhere. This reduces the time it takes to complete financial transactions and makes it easier to manage your finances.

Besides, they often offer better terms and conditions than traditional banks. For example, they may offer higher interest rates on deposits or loans, as well as lower fees for money transfers and other transactions.

Another advantage is accessibility. Many people have limited access to banking services, especially in developing countries. Such projects can offer affordable financial services to such people who previously had no access to these services.

You can create innovative new products and services that traditional banks do not have. For example, it could be automatic investment applications or expense management tools.

The Most Successful Examples of Fintech Apps

The most famous is PayPal. It is a payment system that allows you to send and receive money online. Today, PayPal is one of the most popular payment systems in the world, with millions of customers in different countries. There are many other successful projects, but let us highlight a few of the most famous and popular.

- Venmo — allows you to send and receive money from friends and family. It is popular in the U.S. and offers many features, such as the ability to split a dinner or shopping bill.

- Robinhood — for investing, allows you to buy and sell stocks and other instruments. It quickly became very popular because of its no commissions and simple interface.

- Revolut — banking services, that allow you to open free bank accounts, send and receive money, and use multi-currency cards to travel abroad. It is popular in Europe and offers favorable terms.

- Square Cash — allows you to send and receive money. It is popular in the U.S. and offers a simple interface.

These are just some of the most successful examples of fintech apps. However, keep in mind that success depends on many factors such as product innovation, favorable terms, and effective marketing.

How to Develop Your Fintech App?

Developing a fintech app is a complex and multi-year process that involves many steps and phases. However, we can look at the general creation process and a few masthead fits that can help make your product a success.

- Define your idea ─ Before you begin development, you need to define the concept of the idea. What do you want to do? What problem do you want to solve? How are you going to make money from your app? Define the target audience and the overall concept of your app.

- Make a business plan ─ This step includes determining the monetization of the app, calculating costs and potential revenue; choosing a business model, and other key aspects.

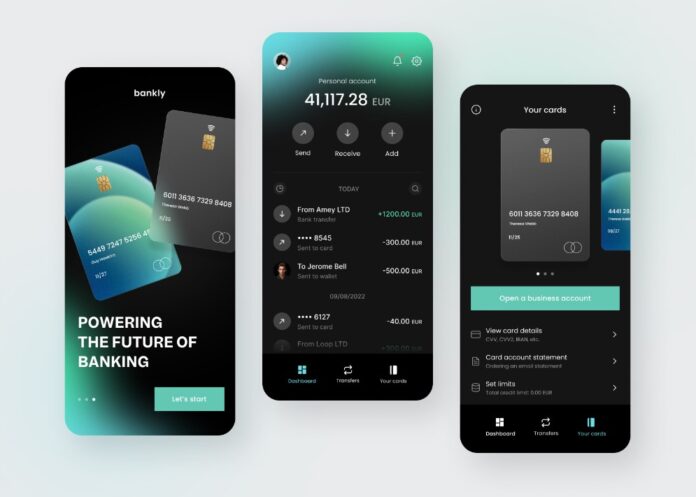

- Interface design ─ You need to design a clear and intuitive interface.

- Development ─ At this stage the development team creates the code, using the appropriate technologies and programming languages.

- Testing ─ After developing the application, you need to test it to make sure that it works and is stable.

- Launch ─ After successful testing, the app is ready to go to market.

Some must-have features include:

- A well-designed interface.

- Data security and privacy protection.

- A variety of payment system features, such as linking to a bank card, the ability to transfer funds, etc.

- Automated accounting functions.

- Integration with third-party services such as social networks and messengers.

The cost of fintech app development can vary greatly depending on many factors, such as the complexity and functionality of the application. the number of developers working on the project, and the location of the development team.

How to Make Money From Your Project

Payment commissions are the most popular way. If you provide payment services, you can charge commissions for each transaction. Many payment processors such as PayPal or Stripe use this approach. There are several basic ways to make money:

- Subscriptions ─ You can provide more access to the app’s functionality for a fee. For example, the app might offer more advanced features or free access for a limited period and then offer a subscription.

- Advertising ─ You can sell advertising space in your app to other companies. However, you need to keep in mind that advertising can be annoying.

- Affiliate agreements ─ You can enter into affiliate agreements with other companies and receive a percentage of the sales or transactions that were made through your app.

- Data collection ─ If your app collects data, you can sell that data to third parties. Keep in mind, however, that this approach may cause resentment if they haven’t given their consent to collect and sell their data.

You can combine different methods of making money depending on their characteristics and target audience. It is important to remember that when developing fintech apps, you need to make sure that it is highly functional and secure to attract and keep customers.